|

|

|

|

|

property tax bill

regular homestead

exemptions

|

|

|

|

|

|

| County - General Fund |

$10,000 |

| County - Recreation Fund |

$7,000 |

| School

- Maintenance and Operation |

$4,000 |

| State |

$2,000 |

|

|

There are several types of homestead exemptions that have

been enacted to reduce the ad valorem taxation of Georgia

homeowners. The regular homestead exemptions shown above

apply to property owned and occupied by the taxpayer as

his or her legal residence of January 1.

|

|

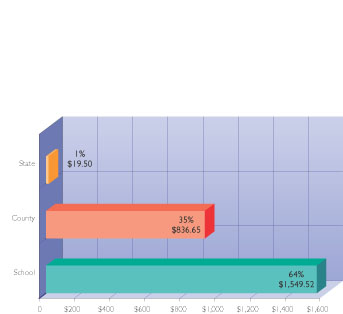

School taxes, with rates set by the Board

of Education, account for 64% of the 2003 Gwinnett County

property tax bill. County taxes, with rates set by

the Board of Commissioners, account for 35% of the total

tax bill. Pending any changes in values that occur in

2003, the amounts below may be slightly lower.

|

|

|

|

|

|

|

|

|

projected

tax bill on a $200,000 home

$2,405.67

|

|

|